The Middle East is well known for some of the most opulent airlines on the planet. In addition, the Middle East is becoming a hotspot for transit as people traverse the globe from one continent to another. After looking at Indian, East Asian and Southeast Asian aviation in the future, now we turn towards the Middle East. Let’s take a look at what the future has in store for these airlines.

Qatar Airways

Qatar Airways is one of the best prepared Middle Eastern airlines for the future. After weathering one of the largest airspace blockades in history, they’re still expanding and offering passengers more connections on enhanced products to new corners of the world.

Qatar Airways is known for their innovation. As other carriers cut costs and seek to increase their ancillary revenue, Qatar is investing in all cabins. Recently, they unveiled a new and improved economy cabin experience. Before that, they revolutionized business class travel with the Qsuite. Arguably, the Qsuite is what has led to the implementation of business class suites with doors on other airlines, including Qatar’s well-known foe, Delta.

Qatar Airways is also charting a course for expansion. Through the use of widebodies and narrowbodies like the A321LR, Qatar Airways is using their position in Doha to offer a range of connections. At the same time, Qatar is also pushing tourism to Doha.

Come 2050, expect Qatar Airways to remain a major force in the Middle East. They have shown an ability to weather turbulence and once their expansion plan stabilizes, chances are, they’ll have built up an enviable network stretching across all continents and major cities. It is unlikely that Qatar would proceed towards building up a fleet of over 1,000 aircraft.

On the other hand, Qatar may pursue additional global investment. Should tensions continue to escalate, the likelihood of Qatar dropping out of the Oneworld alliance in favor of their own multi-airline partnerships could become a reality.

Etihad

If there is one Middle Eastern airline that is most likely to go bust by 2050, it is Etihad. After pursuing an expansion plan, they’ve cut back and are now in major cost-cutting mode. Even then, Etihad continues to post loss after loss.

Should Etihad remain flying in 2050, it is likely that they will remain a boutique airline in the shadow of Emirates. Etihad’s route network will almost certainly be much smaller than that of Emirates. Abu Dhabi is not as big of a tourist destination as Dubai. Despite investments such as a U.S. pre-clearance facility, Etihad can’t out compete either Emirates or Qatar Airways.

Beyond that, it really is up in the air as to what Etihad will look like in 2050. The Emirati government will likely want to avoid the collapse of Etihad. However, bailouts and subsidies for an airline model that isn’t making money do not make much sense. What will determine Etihad’s future is how their cost-cutting program ends up turning out.

Emirates

Emirates is the largest airline in the United Arab Emirates. They largely overshadow Etihad with a massive operation. Emirates flies A380s to every inhabited continent. In this way, Emirates has scaled a massive aircraft, one that many airlines cannot make profitable, and have proven it is possible to turn a profit.

However, Emirates recently started to hit a block with their A380s. They have more than enough of them and wanted to trim their A380 order book. Now, Emirates is changing up their strategy.

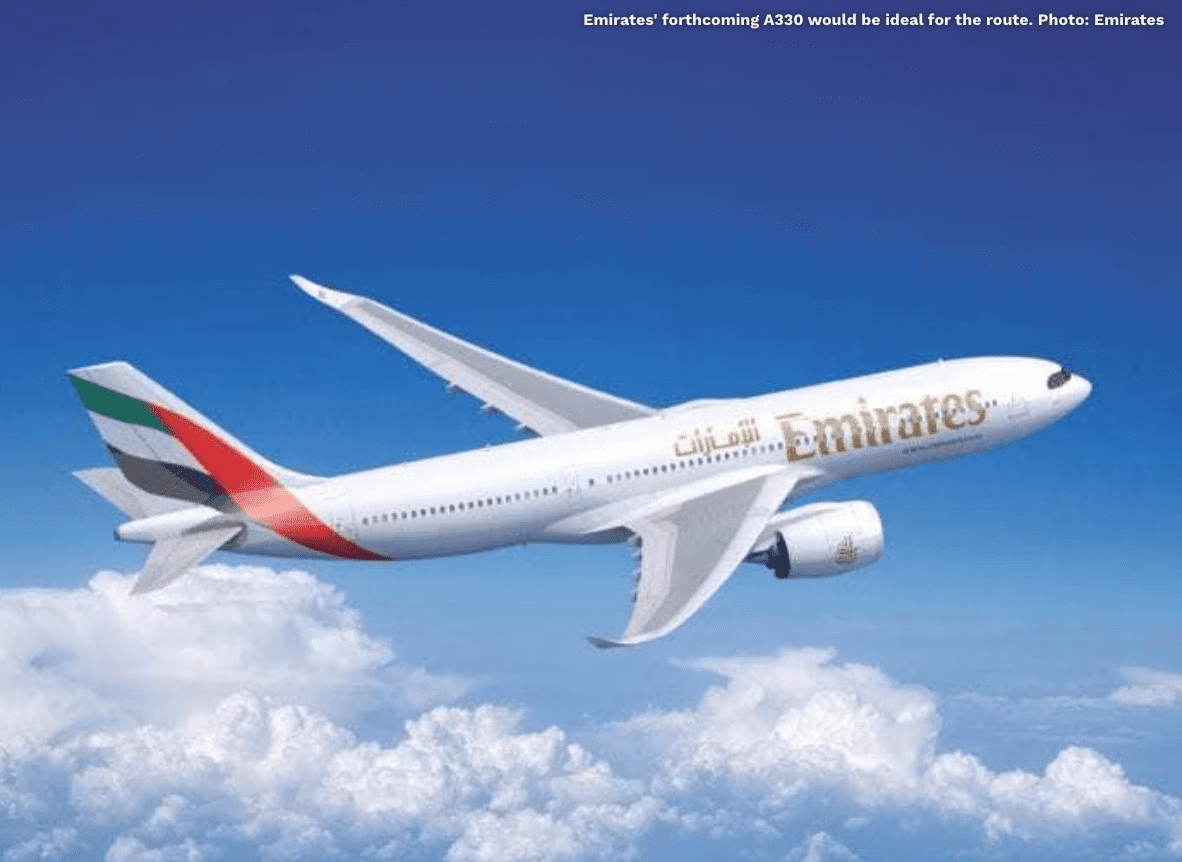

Instead of flying big planes to destinations hoping to fill them with connecting passengers, Emirates is instead looking to fly smaller planes to smaller destinations. These smaller planes will be more fuel efficient and better-sized for smaller destinations that either can’t handle or don’t warrant the use of a 777 or A380.

Emirates also succeeds in part because of Dubai. Dubai is as much of a connecting hub as it is a major destination for many travelers. With access to origin and destination passengers (O&D) and connecting passengers at one mega-hub, Emirates’ operations can be done more efficiently.

In all likelihood, Emirates will remain flying to a significant number of destinations in 2050. The chances of them operating the A380 are slim-to-none since Emirates prefers a younger and more robust fleet. On the other hand, it will be interesting to see what becomes of a second-hand market for the large number of Emirates’ A380s.

Saudia

Saudia is Saudi Arabia’s national airline. Although not as well known as the three big Middle Eastern, or ME3, airlines, they are Saudi Arabia’s largest airline and flag carrier. In addition, with over 150 aircraft in their fleet, Saudia has a larger fleet than that of Etihad. This fleet is comprised of both narrowbody and widebody aircraft.

Saudia is a dry airline and this can be a significacnt disappointment for some premium passengers. As a result, the likelihood of Saudia being a major connecting airline in the Gulf region is smaller than it could be. Saudia has fuel-efficient aircraft that are capable of flying long-haul routes. In addition, they offer suites in First Class.

In all likelihood, Saudia will remain one of the best choices for those flying to Jeddah. Jeddah is one of the easiest air points of access for passengers looking to go to Mecca. This can help explain Saudia’s policy with alcohol. When it comes to trying to infiltrate the global connecting market or remaining one of the top choices for passengers going to Mecca, Saudia will probably stick with what they know and instead continue catering to travelers to and from Saudi Arabia.

In all likelihood, Emirates will remain flying to a significant number of destinations in 2050. The chances of them operating the A380 are slim-to-none since Emirates prefers a younger and more robust fleet. On the other hand, it will be interesting to see what becomes of a second-hand market for the large number of Emirates’ A380s.

Saudia

Saudia is Saudi Arabia’s national airline. Although not as well known as the three big Middle Eastern, or ME3, airlines, they are Saudi Arabia’s largest airline and flag carrier. In addition, with over 150 aircraft in their fleet, Saudia has a larger fleet than that of Etihad. This fleet is comprised of both narrowbody and widebody aircraft.

Oman Air is just starting to grow. Though they don’t operate any flights to North America, that could change as Oman Air takes delivery of more 787 aircraft. In addition, once the 737 MAX is ungrounded, Oman Air can use their MAX aircraft for additional short-haul routes in the region. Oman is not a major tourist destination yet, however, Oman Air could certainly compete against the likes of Qatar and Emirates for connecting passengers.

By 2050, expect Oman Air to grow to a sizeable airline. They could one day launch long- and ultra-long haul flights to destinations in North America and Australia with long-range aircraft like the A350. With a competitive product, Oman Air could really give the ME3 carriers a run for their money– especially if Oman Air starts to beat out the ME3 on price and connectivity.

Overall

The Middle East is a major aviation market and will remain so in years to come. One noticeable aspect missing from the market is a significant low-cost presence that either competes directly with or alters the behavior and operations of full-service carriers. Depending on how passengers respond, low-cost carriers could start encroaching on the revenues and conglomerates Middle Eastern carriers have built up over the years.

As of now, none of the aforementioned airlines have responded to low-cost carrier pressure in a significant manner. Although, Etihad is really on track to start operating like a low-cost carrier with full-service fares.

Source: Simple Flying

Warning: Illegal string offset 'cookies' in /home/u623323914/domains/eng.bayviet.com.vn/public_html/wp-includes/comment-template.php on line 2564