Asia is one of the most important aviation markets in the world. As the most populated continent, there is a lot of scope for market growth. In the previous installment, the future of the East Asian aviation market was analyzed. Now, let’s take a look at Southeast Asia and see what the trends and likely futures are.

The Southeast Asian market

Passenger data published by the World Bank shows growth in each major market. More people are flying within and outside of the region. Tourist interest has grown in Southeast Asia. Vietnam, Thailand, and Indonesia are well-known tourist hotspots with lower prices compared to Europe, Australia, and the United States. In addition, Singapore is a major economic and tourist hub.

Indonesia

According to data published by the United States Census Bureau, Indonesia is the fourth most populous country in the world. This makes it the most populous country in Southeast Asia. As a result, Indonesia has one of the most important aviation markets in the region. However, despite having a large population, beautiful scenery, and culture to explore, Indonesia’s aviation market hasn’t seen growth in the way India and China have.

Indonesia is dominated by two main carriers: Garuda Indonesia and Lion Air. Lion Air is a low-cost carrier. Though, unfortunately, they are more widely known for their recent 737 MAX crash than as a means of low-cost connection in Indonesia. On the other hand, Garuda Indonesia is a full-service carrier that relies on government assistance for a fair share of their operations. Although, they haven’t grown or gotten the reputation carriers like China Eastern, Singapore Airlines, or ANA.

Garuda Indonesia

As the flag carrier of Indonesia, Garuda is the most well-known full-service carrier in Indonesia. A member of Skyteam, Garuda Indonesia operates primarily out of Jakarta and Denpasar.

A flag carrier in a populous country should be doing quite well. However, it simply isn’t the case at Garuda Indonesia. Unlike Air India, Garuda doesn’t face significant competition from full-service carriers. Instead, Garuda has seen a consistent case of mismanagement.

In the past three years, the airline has had three different CEOs. Each CEO brings a vision for the airline that starts to materialize but ultimately doesn’t get fully implemented. Then, a new CEO comes in with a different vision which delays any sort of turn-around at Garuda.

Furthermore, Garuda’s route network is limited to major points in Asia and Australia and one in Europe. Despite having a fair number of A330 and 777 widebodies, Garuda just doesn’t have the kind of long-haul network that the likes of ANA and KLM have. The only real consistent route Garuda operates to Europe is Jakarta to Amsterdam (Skyteam partner KLM’s hub).

When it comes to London, Garuda has experimented with flights to Gatwick via Amsterdam and even a strange routing from Jakarta to Heathrow to Bali. A warning sign for Indonesian aviation is that Garuda can’t make European routes work even with access to connecting partners. This puts a significant damper on their long-haul expansion plan.

Passengers looking to fly to Europe from Jakarta have options. They can connect on carriers like KLM, Emirates, Etihad, Qatar, Turkish, Oman, etc. However, it is very interesting that Garuda can’t make long-haul routes to Europe work, but Vietnam Airlines can. Part of this may be the reason why Garuda is looking at acquiring some 787s, as these may be more economically viable for European routes compared to their high-density 777s.

Ultimately, by 2050, if Garuda Indonesia doesn’t operate nonstop flights to Europe, it should be troubling for Indonesia. The aviation market is only getting more competitive and if Garuda can’t get a grasp of long-haul flights turning over a significant profit, they likely will lose some of their relatively slim share of the Indonesian market.

Lion Air

Meanwhile, Indonesians have shown a penchant for Lion Air. Lion Air is an expanding low-cost carrier. As their market share in Indonesia grows, Lion Air could deal a death-blow to Garuda, particularly if they are able to start flying to more long-haul destinations to places like Sydney and points in Europe.

Low-cost carriers are one of the catalysts for expanding aviation markets. The ability to allow more passengers to fly for less increases access to flight and travel. Lion Air has done just that. Furthermore, they show no sign of slowing down. In 2050, expect low-cost carriers to make up a majority of Indonesia’s aviation market.

Thailand

Thai Airways saw its glory days in the early 2000s. With expansion on the horizon, Thai Airways perhaps went a bit too far when they put gas-guzzling A340s on nonstops to the United States. With a brand new airport, solid order books (including for A380s), a new marketing scheme, and reputation as a founding member of Star Alliance, Thai was well on its way to being one of the premier carriers in Southeast Asia. That was, until everything changed.

Political instability in Thailand, escalating fuel prices, and the Great Recession came together to give Thai one of its largest losses ever. After some period of volatility, Thai has consistently shown losses with their operations. If Thai survives these few years and turns around, it is unlikely they will return to their major expansions of the past.

Furthermore, Garuda’s route network is limited to major points in Asia and Australia and one in Europe. Despite having a fair number of A330 and 777 widebodies, Garuda just doesn’t have the kind of long-haul network that the likes of ANA and KLM have. The only real consistent route Garuda operates to Europe is Jakarta to Amsterdam (Skyteam partner KLM’s hub).

When it comes to London, Garuda has experimented with flights to Gatwick via Amsterdam and even a strange routing from Jakarta to Heathrow to Bali. A warning sign for Indonesian aviation is that Garuda can’t make European routes work even with access to connecting partners. This puts a significant damper on their long-haul expansion plan.

Passengers looking to fly to Europe from Jakarta have options. They can connect on carriers like KLM, Emirates, Etihad, Qatar, Turkish, Oman, etc. However, it is very interesting that Garuda can’t make long-haul routes to Europe work, but Vietnam Airlines can. Part of this may be the reason why Garuda is looking at acquiring some 787s, as these may be more economically viable for European routes compared to their high-density 777s.

Ultimately, by 2050, if Garuda Indonesia doesn’t operate nonstop flights to Europe, it should be troubling for Indonesia. The aviation market is only getting more competitive and if Garuda can’t get a grasp of long-haul flights turning over a significant profit, they likely will lose some of their relatively slim share of the Indonesian market.

Lion Air

Meanwhile, Indonesians have shown a penchant for Lion Air. Lion Air is an expanding low-cost carrier. As their market share in Indonesia grows, Lion Air could deal a death-blow to Garuda, particularly if they are able to start flying to more long-haul destinations to places like Sydney and points in Europe.

Low-cost carriers are one of the catalysts for expanding aviation markets. The ability to allow more passengers to fly for less increases access to flight and travel. Lion Air has done just that. Furthermore, they show no sign of slowing down. In 2050, expect low-cost carriers to make up a majority of Indonesia’s aviation market.

Thailand

Thai Airways saw its glory days in the early 2000s. With expansion on the horizon, Thai Airways perhaps went a bit too far when they put gas-guzzling A340s on nonstops to the United States. With a brand new airport, solid order books (including for A380s), a new marketing scheme, and reputation as a founding member of Star Alliance, Thai was well on its way to being one of the premier carriers in Southeast Asia. That was, until everything changed.

Political instability in Thailand, escalating fuel prices, and the Great Recession came together to give Thai one of its largest losses ever. After some period of volatility, Thai has consistently shown losses with their operations. If Thai survives these few years and turns around, it is unlikely they will return to their major expansions of the past.

But first, Thai will have to contend with allegations of corruption within the airline. Undoubtedly, Thai will face political headwinds that could hamper its plan for the future.

Low-cost carriers in Thailand

Thailand doesn’t have as large of a low-cost presence as other countries, however, low-cost carriers are growing. Some of the more well known ones include Thai Air Asia and Thai Lion Air. With backing from large parent companies, these low-cost carriers have the potential to expand.

Looking ahead, it will be interesting to see how these low-cost carriers respond to each other. Whether or not Thailand can sustain multiple large low-cost carriers has yet to be tested. Nevertheless, the market will forever be shaped by the introduction of such carriers.

Malaysia

Arguably, Malaysia’s most important carrier is not the flag carrier Malaysia Airlines, but instead, is low-cost carrier Air Asia.

As Malaysia Airlines struggles to regain stability and make progress towards profitability, Air Asia continues to grow. While still a low-cost carrier, on longer routes, Air Asia does offer passenger the opportunity to book into a “premium flatbed”.

For many price-sensitive passengers on a long-haul route, the opportunity to have an angle-flat on a low-cost carrier is better than coach seating, even on a full-service carrier. By offering both long-haul comfort and short-haul connectivity, Air Asia straddles the boundaries between a low-cost and full-service carrier.

This places them directly in competition with the likes of Malaysia Airlines. Given Air Asia’s more stable financial history, it is more likely that Air Asia will outlast and remain larger than Malaysia Airlines.

In addition, Air Asia is likely to outpace Malaysia Airlines when it comes to offering connections. Should Air Asia continue to grow and maintain profitability, Malaysia Airlines could find themselves as a boutique national airline in the shadow of the low-cost behemoth. That is, assuming Malaysia Airlines lasts until 2050.

Philippines and Vietnam

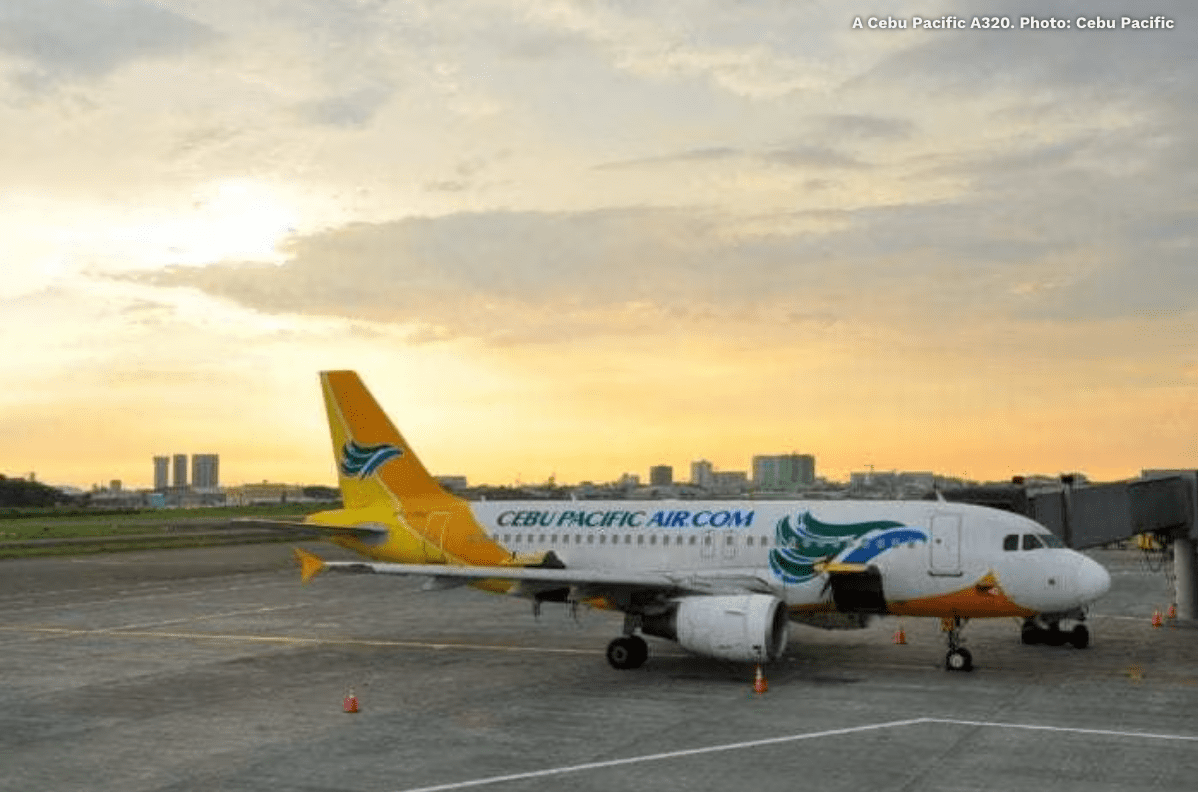

Philippines and Vietnam share similar aviation markets. Both have major full-service carriers that serve long-haul and short-haul destinations. These are Philippine Airlines and Vietnam Airlines, respectively. Both countries have similar passenger numbers. In addition, both have seen the rise of low-cost carriers. In the Philippines, there is a branch of low-cost behemoth Air Asia in addition to the more established Cebu Pacific. Meanwhile, in Vietnam, low-cost carriers are on the rise.

Philippine Airlines and Vietnam Airlines benefit from having a new fleet capable of operating long-haul routes with lower operating costs. This gives them a solid standing against the rise of low-cost carriers. Furthermore, as low-cost carriers expand, these full-service carriers are able to offer passengers enhanced experiences and connecting opportunities. Both offer lie-flat experiences in business class.

While Vietnam Airlines will have to contend with Bamboo Airway’s ambitious 787 plans, Vietnam Airlines can hopefully get ahead of the game by launching long-haul flights before Bamboo.

On the other end, low-cost carriers are present in both the Philippines and Vietnam. The most prominent carrier in the Philippines is Cebu Pacific. Cebu Pacific has found a niche in operating a mix of long-haul and short-haul destinations in an all-economy configuration.

Vietnam’s largest low-cost carrier is VietJet Air which has over 300 aircraft on order- including Boeing 737 MAX variants. VietJet doesn’t have plans to operate long-haul routes to destinations in Europe and Australia, however, they will likely offer a large number of short-haul connections. Nevertheless, Vietnam Airlines and Philippine Airlines are primarily marketing their connectivity and gain passengers who need to fly to far-away destinations.

Come 2050, both markets should still have major full-service carriers operating alongside large low-cost carriers. Passenger demand to these countries, especially Vietnam, will continue to grow and additional flights to destinations in Europe and the Americas are likely to materialize within the next few years.

Singapore’s aviation market begins and ends with Singapore Airlines.

Singapore Airlines is known as one of the best airlines in the world. From the world’s longest flight to one of the world’s shortest flight with flatbed seats, Singapore Airlines runs a massive operation that allows for a massive number of connections. Passengers from points as far away as the Americas and Europe can fly Singapore to destinations in Australia and Southeast Asia.

However, Singapore Airlines has another thing going for them. That is Singapore itself. The city is a hub for business and tourist travelers alike. As the city grows and maintains its status as a hub for tourism and businesses, Singapore will likely remain the best carrier flying in Southeast Asia and one of the best in the world.

The real question for Singapore Airlines, come 2050, is how much Singapore Airlines can continue to grow. There is a fine line between expansion and profitability. As we’ve seen far too many times, rapid expansion can sometimes lead to a painful demise. Singapore, however, seems to have this down. They have been flying for many years and have avoided significant negative financial headlines. Out of all the carriers in Southeast Asia, Singapore Airlines is the most likely to remain flying in 2050.

Overall

Southeast Asia is a fascinating place to visit and analyze. From stunning cities, plentiful natural scenery, and strong business demand, Southeast Asia will remain one of the most important aviation markets in the world.

Tourism demand will continue to grow and as flying becomes more accessible and affordable for more people, so will passenger numbers originating in Southeast Asia.

Source: Simple Flying

Warning: Illegal string offset 'cookies' in /home/u623323914/domains/eng.bayviet.com.vn/public_html/wp-includes/comment-template.php on line 2564